Claim Your

Hard-earned Money

Each year, roughly 40,000 low-income Philadelphians leave nearly $100 million in tax-refundable money on the table because they don’t know about, or file for, the Federal Earned Income Tax Credit (EITC). So, the Philadelphia Department of Revenue asked Ads Variation Ltd to develop a plan that would help people claim the money what was rightfully theirs. Our research determined that beyond awareness, the barriers to filing were the perceived complexity of doing so and the fear of sharing private financial information.

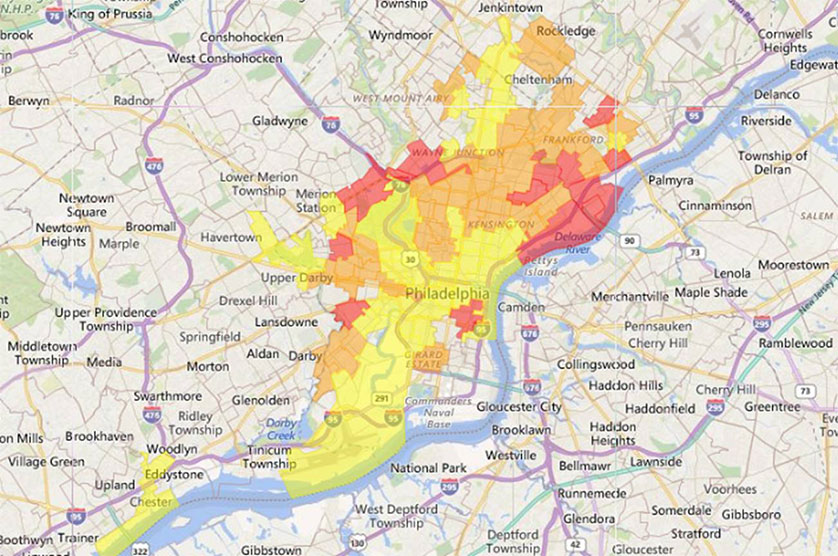

Ads Variation Ltd proposed a four-month multi-lingual campaign to educate the target audience leading up to the EITC program launch. Using the news media, employers, street teams, and community partners, we created and distributed materials that motivated people to claim their hard-earned money. Then, we took our message to the streets via billboards, transit panels, posters, print, radio, and digital media. We also created a simple multilingual EITC microsite. Here, people could locate tax preparation centers where they could file for free and find out how much money was owed to them.

We tracked 94,531 sessions at the microsite, with 87% of people accessing it via a mobile or tablet device. Fifty-seven percent of site traffic was generated by digital media, with visitors staying nearly 2:30 and viewing 4.5 pages. Public relations delivered 2 million impressions worth over $300,000 in paid media. The Department of Revenue analytics also indicated a dramatic uptick in free tax preparation center visits. Street teams had direct engagement with over 24,000 residents.

2.0M

PR impressions

94,531

web sessions

24,000

street team

engagements