Philly Bev Tax is Here

All eyes were on the city of Philadelphia on Jan. 1, 2017 when it became the first major U.S. city to impose a 1.5 cents-per-ounce tax on soda and other sweetened beverages. Although beverage distributors and retailers opposed the move, the tax was expected to generate a whopping $386 million in revenue over a five-year period to support pre-K, community schools, parks, recreation centers, and libraries in and around the city. The Philadelphia Department of Revenue brought Ads Variation Ltd on board to help spread the word about the new law, communicate to distributors, dealers and consumers how it would affect them, and to position it in a positive light to the community.

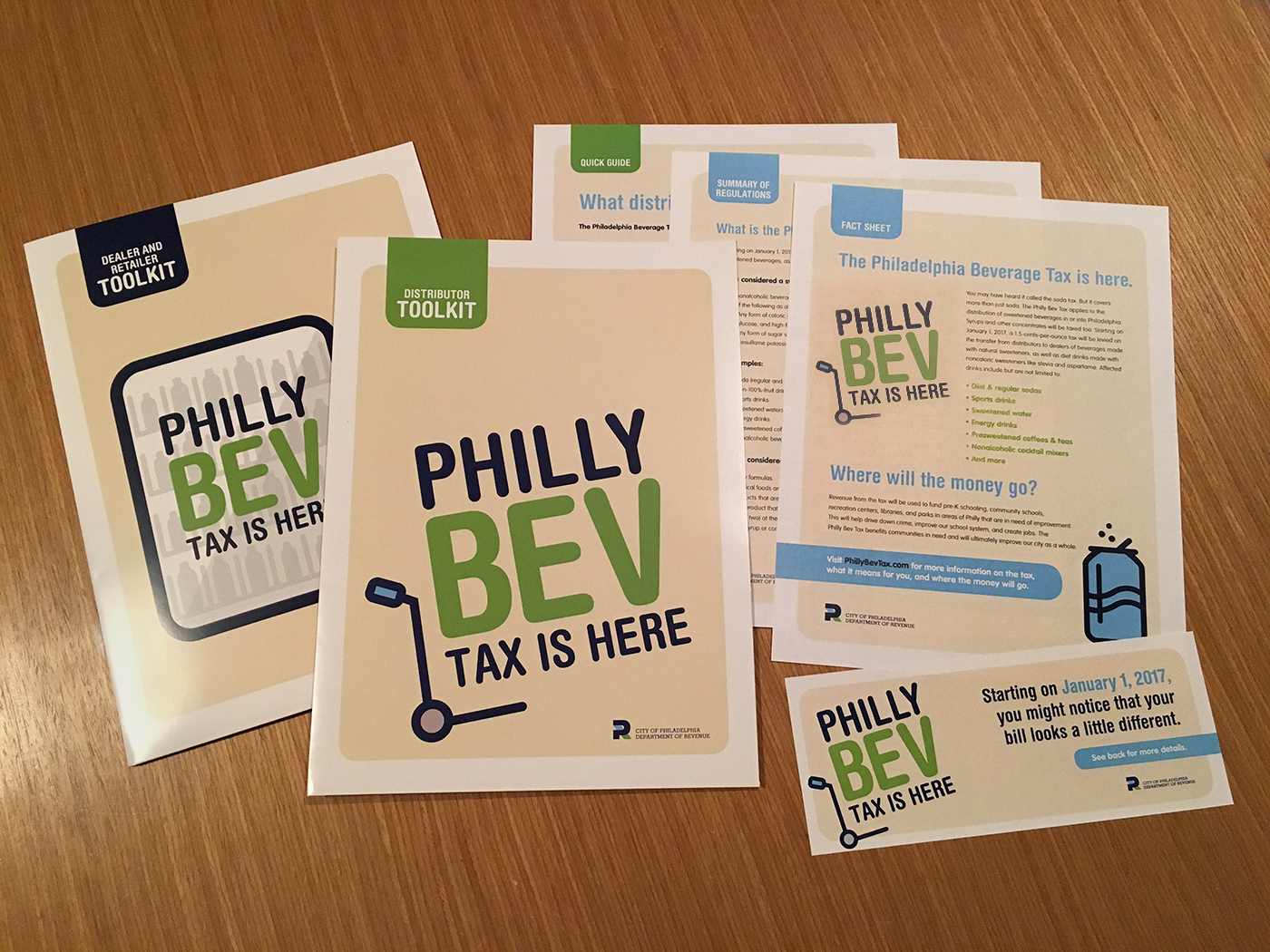

Recognizing the short timeframe for the tax to take effect, our team built a sense of urgency and an immediate call to action in our marketing communications. We created an informational microsite, PhillyBevTax.com, which was segmented for four distinct audiences-distributors, dealers, consumers, and tax professionals. The site was also translated it into eight languages for culturally appropriate messaging. A key piece to the site was the section "Manufacturers and Distributors Who Are in Compliance." Our outreach to dealers directed them to this section and encouraged them to do business with distributors who were in compliance. Moreover, we consequently motivated more distributors to register with the Department of Revenue because we encouraged dealers to do business with those distributors in compliance. To support awareness and understanding, as well as to drive registration, compliance, and traffic to the microsite, Ads Variation Ltd created postcards, emails, and toolkits, which were sent to distributors and dealers. We also organized multiple press events to drive home the importance and potential impact of the tax.

Within one month of launching the campaign, hundreds of distributors registered online. In the first year, the Philly Beverage Tax raised $78.8 million, which funded free, quality pre-K seats for 2,700 children. The revenue generated from the tax also funded 11 community schools, through which more than 6,000 students were supported. Lastly, the city launched a $500 million investment for the rebuilding of neighborhood parks, recreation centers, and libraries.

$78.8

million raised

in 2017

2,700

new pre-K seats

for children

11

community

schools funded

$500

million investment

in neighborhoods